The Australian fabrication industry is characterised by a diverse range of fabricators operating across a range of markets from industrial buildings to complex structures in the oil and gas markets.

Of the approximately 8 million tonnes annual capacity of Australian steelmakers, total market output of fabricated steelwork is approximately 1.6 million tonnes/annum, comprising steelwork for industrial, commercial and residential buildings, bridges, towers and masts, maritime structures, mining and materials handling projects. The medium and larger fabricators process approximately 1.1 million tonnes/annum, with the largest fabricators producing in excess of 20,000 tonnes per annum.

The Australian fabrication industry capacity is extended by the outsourcing of some functions to specialist subcontractors in areas such as steel detailing, blast cleaning, painting, galvanising, non-destructive testing, grating and handrail manufacture, bending and transportation. A vibrant and competitive market for subcontracted services ensures the industry produces cost-effective, high-quality solutions consistent with international good practice.

Australia can be a difficult and perhaps unique market on the world stage, being a well-developed first world country with high living standards but without the internal market size of some of our trading partners and competitors to support a globally robust fabrication industry.

Recognising the competitive pressures that the international procurement environment has brought to Australia’s doorstep, the industry has responded through innovation and investing in improved capability and mechanisms. This has increased effective capacity to help ensure the Australian fabrication industry secures sufficient project work to support what is a significant extended manufacturing community and Australia’s continuing manufacturing knowledge base.

The structural steel fabrication community in Australia has the capability to work with clients to meet project challenges. In particular it can leverage local expertise and innovation capital to ensure that projects are fabricated on schedule, on budget and compliant with the community expectations of quality and minimised risk. The inherent capability to ‘get things done’ responsive to project schedule is a valuable local asset to have on your side.

For more, see the information contained in our Steel industry capability page.

The Australian structural steel sector is about equivalent in capacity to the highly regarded UK fabrication industry, but with a focus on the engineering projects sector. The local fabrication industry has invested heavily in innovation, with new plant and automation expanding capacity and improving efficiency.

For more, see the information contained in our Steel industry capacity page.

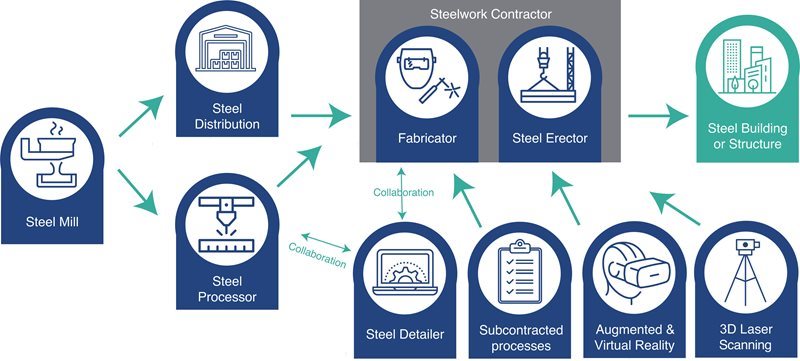

The steelwork (fabricated steel) supply chain takes the steel members and plates supplied from our steel mills and turns them into the functional and aesthetic steel structures our community utilises every day. While the beginning and end products for this supply chain are well defined, the inter-relationships in the supply chain are continually evolving in order to provide cost-effective, timely solutions. That evolution is underpinned by innovation, workplace health and safety improvements and value engineering.

The infographic below provides a view of the supply chain, the stakeholders and the evolving processes that are driving outcomes. Please also refer to our Digital Construction page for more detail on the exciting developments helping to frame our ‘future steel’

Structural steel distributors have acted as the link between the producer (the steel mill) and the fabricator. In that capacity they provide a significant service to the supply chain by:

ensuring responsive supply from stock for small-to-medium-size project requirements

providing supply in a diverse range of geographical locations without delays

negotiating with steel mills for larger orders

ensuring that materials supplied meet the requirements of the purchase order and the relevant Standards quoted. Product packaging, marking and traceability are important components of ensuring compliant supply that must be maintained by the distribution channel.

Structural steel distributors have acted as the link between the producer (the steel mill) and the fabricator. In that capacity they provide a significant service to the supply chain by:

ensuring responsive supply from stock for small-to-medium-size project requirements

providing supply in a diverse range of geographical locations without delays

negotiating with steel mills for larger orders

ensuring that materials supplied meet the requirements of the purchase order and the relevant Standards quoted. Product packaging, marking and traceability are important components of ensuring compliant supply that must be maintained by the distribution channel.

There are two distinct categories of steel products: ‘long’ and ‘flat’. Long products include structural beams, columns, channels and angles, tube and pipe. Flat products include plate (more than 3mm thick) and coil (less than 3mm thick). Plate is usually ordered to size due to cost considerations, so plasma and oxy cutting machines are needed by distributors for this purpose.

Distributor member companies are listed in our Industry Directory.

The pervasive implementation of fabrication technology and numerical control driven by data fed from advanced CAD systems has led to the introduction of automated fabrication machinery such as ‘beam lines’, which can cut to length, cope and drill holes in long products, and automated plasma cutting machines. While initially targeted at fabrication shops, this technology has also been adopted by a number of distributors who can now offer services to cut and hole beams and other long products and plate products to order.

These distributors, who perform certain easily automated fabrication tasks, have come to be termed ‘steel processors’.

The introduction of steel processors into the supply chain is a significant and potentially cost-effective change to the traditional supply chain operation. By automating highly repetitive and labour intensive tasks, and spreading the up-front cost of automation across quantity output, steel processors have enabled an alternative supply path that may be cost effective for certain project types.

Projects with straightforward beam and column work with members that require no or minimal welding can benefit from initial processing and, in some cases, can go straight from the processor to paint shops with no other fabrication input. Increasingly, projects are being designed and detailed to maximise processing opportunities. See, for example, the ASI Tech Note on bolted angle cleats, a connection option that maximises the opportunity for steel processing.

High-speed drill and cutting machine for steel profiles. Courtesy Structural Challenge.

The introduction of steel processors into the supply chain is a significant and potentially cost-effective change to the traditional supply chain operation. By automating highly repetitive and labour intensive tasks, and spreading the up-front cost of automation across quantity output, steel processors have enabled an alternative supply path that may be cost effective for certain project types.

Projects with straightforward beam and column work with members that require no or minimal welding can benefit from initial processing and, in some cases, can go straight from the processor to paint shops with no other fabrication input. Increasingly, projects are being designed and detailed to maximise processing opportunities. See, for example, the ASI Tech Note on bolted angle cleats, a connection option that maximises the opportunity for steel processing.

Structural steelwork detailers specialise in preparing detailed ‘shop drawings’ for the manufacture and erection of the steel framework used in the construction of buildings, bridges and infrastructure. The steel detailing information is extracted from interpretation of the structural engineer’s drawings and project specifications.

Significant innovation has impacted the steel detailing process, with 3D computer aided drafting (CAD) software, building information modelling/management (BIM), 3D laser scanning and numerically controlled fabrication processes all becoming more commonplace. Read more about it here.

Fabrication is the process used to manufacture steelwork components that will, when assembled and joined, form a complete frame. The frame generally uses readily available standard sections that are purchased from the steelmaker or steel stockholder, together with such items as protective coatings and bolts from other specialist suppliers.

For more, see the information contained in our Fabrication process page.

Fabrication of structural steelwork. Courtesy Structural Challenge.

The erection of structural steelwork consists of the assembly of steel components into a frame on site. The processes involve lifting and placing components into position and then connecting them together. Generally, connection is achieved through bolting, but in some cases site welding is used. The assembled frame needs to be aligned to within tolerance expectations (usually defined in our Standards) before final bolting up is completed. The completed steel frame may then be handed over for further work on internal floors, external cladding and mechanical and electrical fitments.

For more, see the information contained in our Erection of Steel Structures page.

See here for the Practical Guide to Planning the Safe Erection of Steel Structures (PDF).

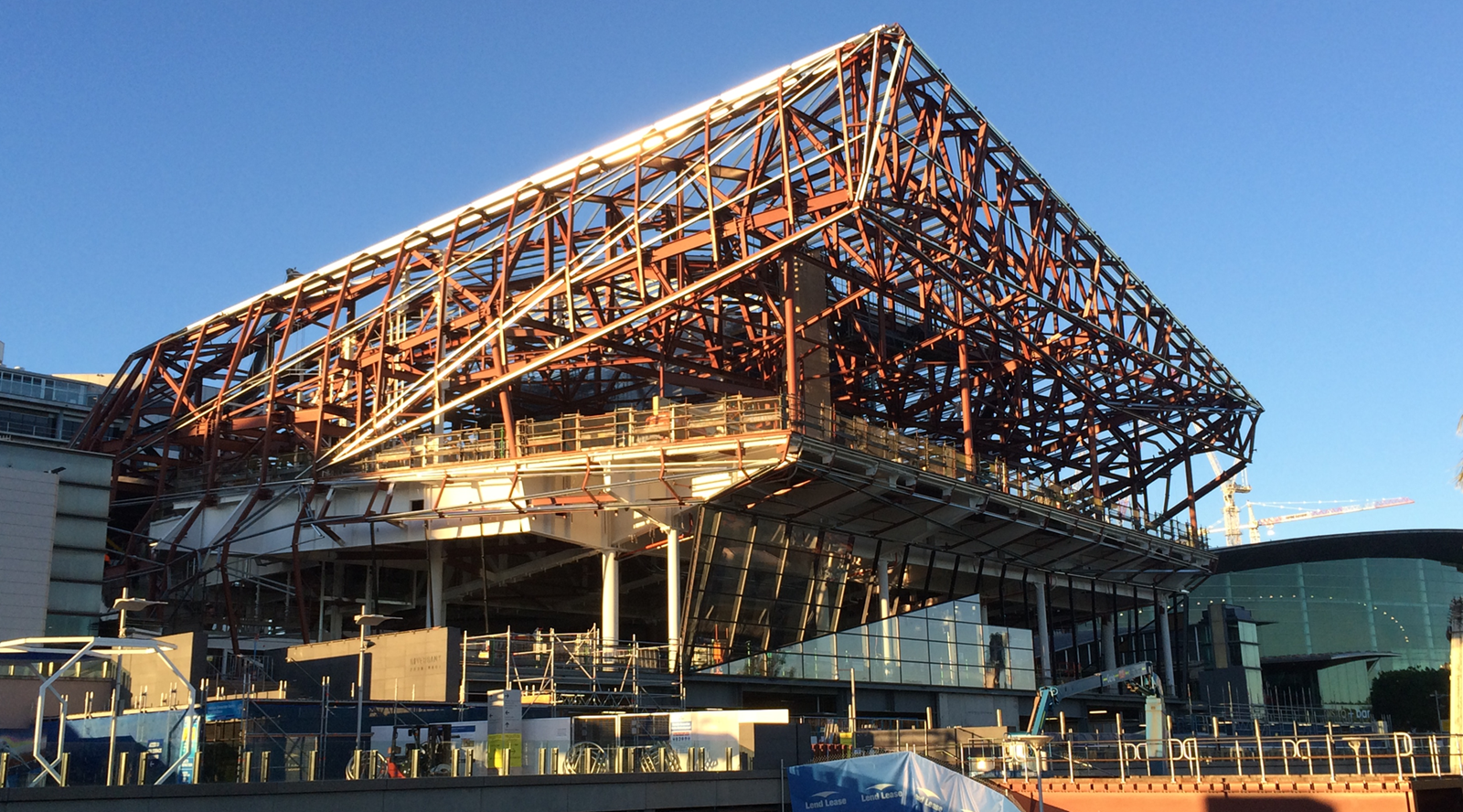

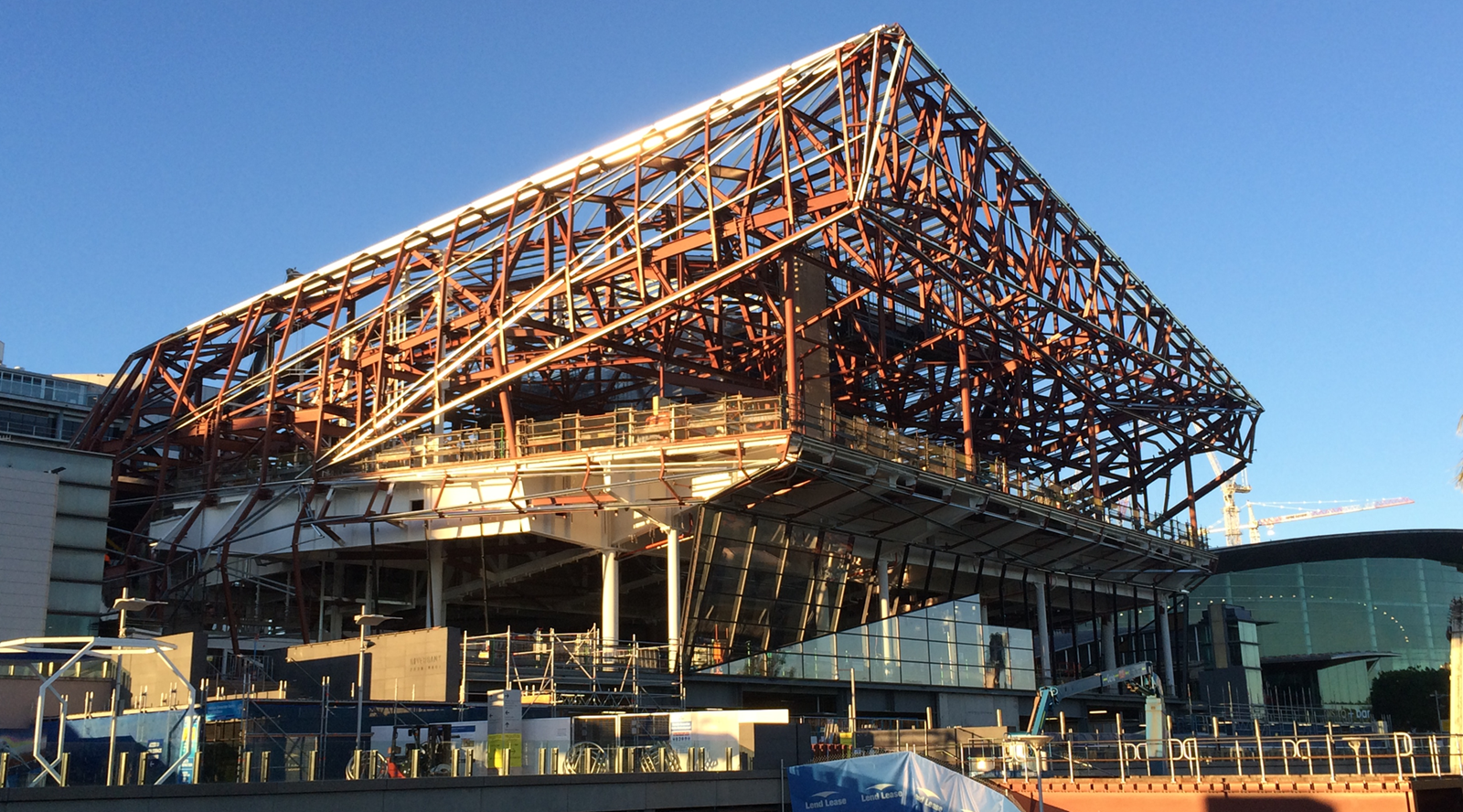

Innovation in construction of steelwork structures is endemic, driven by continual striving for cost-effective, time-efficient and risk-minimised solutions in a nationally and internationally competitive market. Every steel structure is ultimately a bespoke design, responding to external environmental influences and complex user requirements. Therefore, every solution has the capacity for innovation to provide differentiation in a crowded marketplace.

Take a look at our page on innovation in steel structures in current practice and view the ASI Steel Innovation Portal for a holistic view on new innovation under development in the steel industry.

The steelwork supply chain has an important and shared responsibility to ensure compliant steel structures are provided to our community. The ASI has been on a journey to work with the supply chain, government and our community to ensure compliant outcomes. The imperative is clear and, under our Workplace Health and Safety Regulation and emerging non-compliant building products chain of responsibility regulation, not negotiable.

Many fabricators have been certified under the ASI ‘National Structural Steelwork Compliance Scheme by Steelwork Compliance Australia.